Content Warning

Hmmmmm, I do seem to see some progression. It’s getting worse every generation.

#uspol#removeTrump #trump

Content Warning

Content Warning

Content Warning

I really hope you can, but we just went through the same threat here in Canada, from essentially the same source. Our Conservative Party of Canada has modeled itself after your Republican Party, and has also been launching attacks against our national public broadcaster (CBC) for the same reason that Trump hates PBS and NPR.

There was only one clear way to save the CBC though, and that was to vote against the Conservative Party to keep them from forming government Federally, which is what we did on our Federal election day on April 28th.

That's why I worry deeply for PBS, NPR, for all Americans, and for all the parts of the world who were relying on these "free world" broadcasters to counter dictatorship misinformation. Because your ship has sailed, since last November.

I do hope and expect that there is more you can do, but the only clear-cut answer has already passed. :(

Content Warning

Surprise! Every action has knock - on effects, and the knock-on effects have knock-on effects.

Content Warning

The US is racing toward fascism including the eugenics part. They plan to create a national "disease database" that will start with autistic people. RFK Jr has talked about building detainment camps for people on Adderall. That psycho would love nothing better than to exterminate everyone he thinks s 'defective.'

"Tracking people with ASD in a database is fascistic and terrifying."

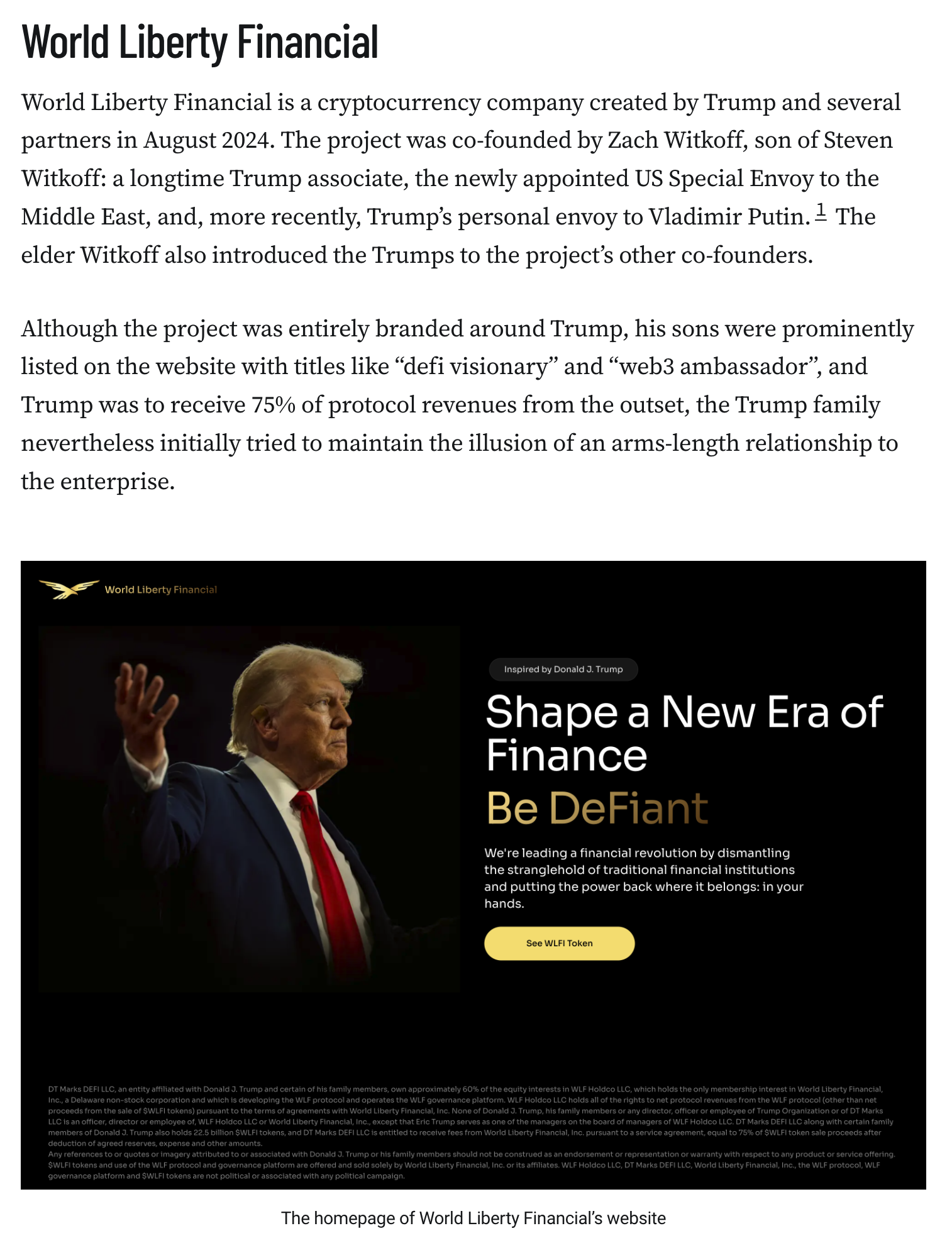

Trump receives 75% of protocol revenues and owns a 60% stake in the World Liberty Financial crypto business. This has already netted him almost a $400 million claim on token sale revenue, even though no platform has been launched yet.

The project has already faced accusations of insider trading, and is reportedly in talks to work with Binance as Binance is simultaneously petitioning the US Treasury department to remove the compliance monitor as a result of the company’s criminal conviction.

Content Warning

(Newly tracked at https://www.followthecrypto.org/quidproquo)

Content Warning

Trump receives 75% of protocol revenues and owns a 60% stake in the World Liberty Financial crypto business. This has already netted him almost a $400 million claim on token sale revenue, even though no platform has been launched yet.

The project has already faced accusations of insider trading, and is reportedly in talks to work with Binance as Binance is simultaneously petitioning the US Treasury department to remove the compliance monitor as a result of the company’s criminal conviction.

![Allegations of insider trading and quid pro quo deals [I76] have plagued the project, particularly amid reports of unusual token swaps with other cryptocurrency companies. For example, a World Liberty deal to acquire around $2 million of a Movement Labs token coincided with rumors of Movement’s talks with Elon Musk’s Department of Government Efficiency about integrating blockchain technology into government operations. (Both World Liberty and Movement Labs denied these allegations.)4 But an April 8 memo from Deputy Attorney General Todd Blanche, citing Trump’s executive order on crypto, dismantled the Department of Justice’s cryptocurrency investigations team and directed the Market Integrity and Major Frauds Unit to “cease cryptocurrency enforcement”. This may well have eliminated any remaining chance of a federal investigation into allegations of malfeasance in a business venture controlled by the president and his family [I81].

As for the stablecoin, the timing is significant: World Liberty Financial announced plans to issue USD1 on March 25, and just ten days later the Securities and Exchange Commission published a statement declaring that "covered" stablecoins fall outside its authority, and that companies issuing stablecoins need not register.5 Meanwhile, a Trump-aligned Congress is working to pass new, friendly stablecoin legislation [I79] with substantial direction from the cryptocurrency industry, which spent over $130 million installing crypto-friendly legislators](https://media.hachyderm.io/media_attachments/files/114/355/777/214/775/738/original/f150e82be4123c6c.png)

![When Trump was inaugurated, he dropped the pretense and took majority control of the company with a 60% stake.2

The project hasn’t launched a trading platform, but the Trumps have discussed a decentralized finance platform for crypto financial services with promises of “democratiz[ing] finance”.2 Recently, World Liberty announced its own stablecoin, USD1 (despite Trump’s past warnings about similar cryptocurrencies, which he described as currencies that “would give a federal government — our federal government — absolute control over your money” [I80]).

And not having any actual platform to speak of has of course not limited World Liberty Financial from raking in money — it raised $550 million in its initial $WLFI token sale, putting Trump’s 75% cut at almost $400 million. $75 million came from Justin Sun, a crypto entrepreneur with a shady past [I71] who, as a foreign national, couldn’t contribute to Trump’s campaign. He was, at the time, facing a lawsuit from the Securities and Exchange Commission alleging fraud. Recent reporting also suggests he was under investigation by the Justice Department, at least as of late 2024.3 With his investment, he earned an advisory position with World Liberty Financial, and shortly after Trump was inaugurated, the SEC case against him and his company was stayed pending potential resolution [I78].](https://media.hachyderm.io/media_attachments/files/114/355/776/194/394/953/original/a5316277f0f31770.png)

Content Warning

(Newly tracked at https://www.followthecrypto.org/quidproquo)

Content Warning

Content Warning

Content Warning

https://blog.yaleappliance.com/tariffs-and-appliance-buying-in-2025

Content Warning

Seeing what we have seen with the #PresidentialElection2024, the #SecondTrumpAdministration, the #TradeWar2025/ #TrumpTariffs, and #DOGE, people just don't realize that, unlike in the past, there's only one real option and then there's doom. That's beyond comparison, yet they try

#Bothsiderism#DonaldTrump#Trump#Musk#ElonMusk #uspol #politics

Content Warning

Content Warning

For the life of me I cannot think of a single compelling reason why it should be plugged in again.

Content Warning

Content Warning

#RuleOfLaw#Trump#InterNationalSecurityThreat#InternationalPariah#AmericaDeservesBetter#AmericaHasBetter#HarrisWalz#Law#Democracy#Freedom#DEI#USPol#USPolitics#DisqualifyTrump#DisqualifyJDVance#DisqualifyTrumpAppointees#ExpelMusk#KremlinAssets#BetrayalOfCountry#Insurrection#ObstructionOfUSGovernment#ObstructionOfNationalDefense#DefraudingAmerica

Content Warning

Content Warning

Content Warning

Content Warning

This is not a drill.