Content Warning

Content Warning

Content Warning

Content Warning

(Newly tracked at https://www.followthecrypto.org/quidproquo)

Content Warning

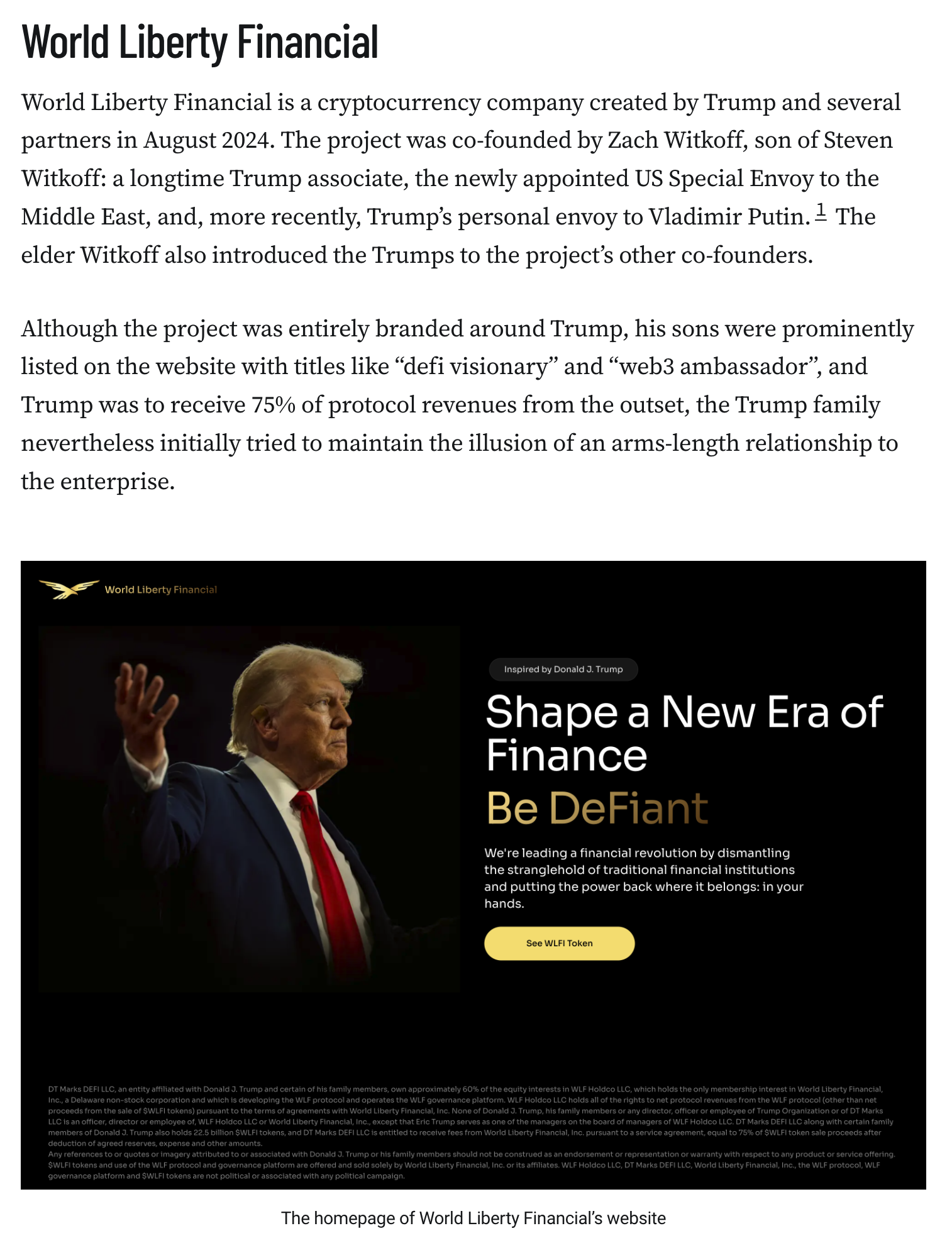

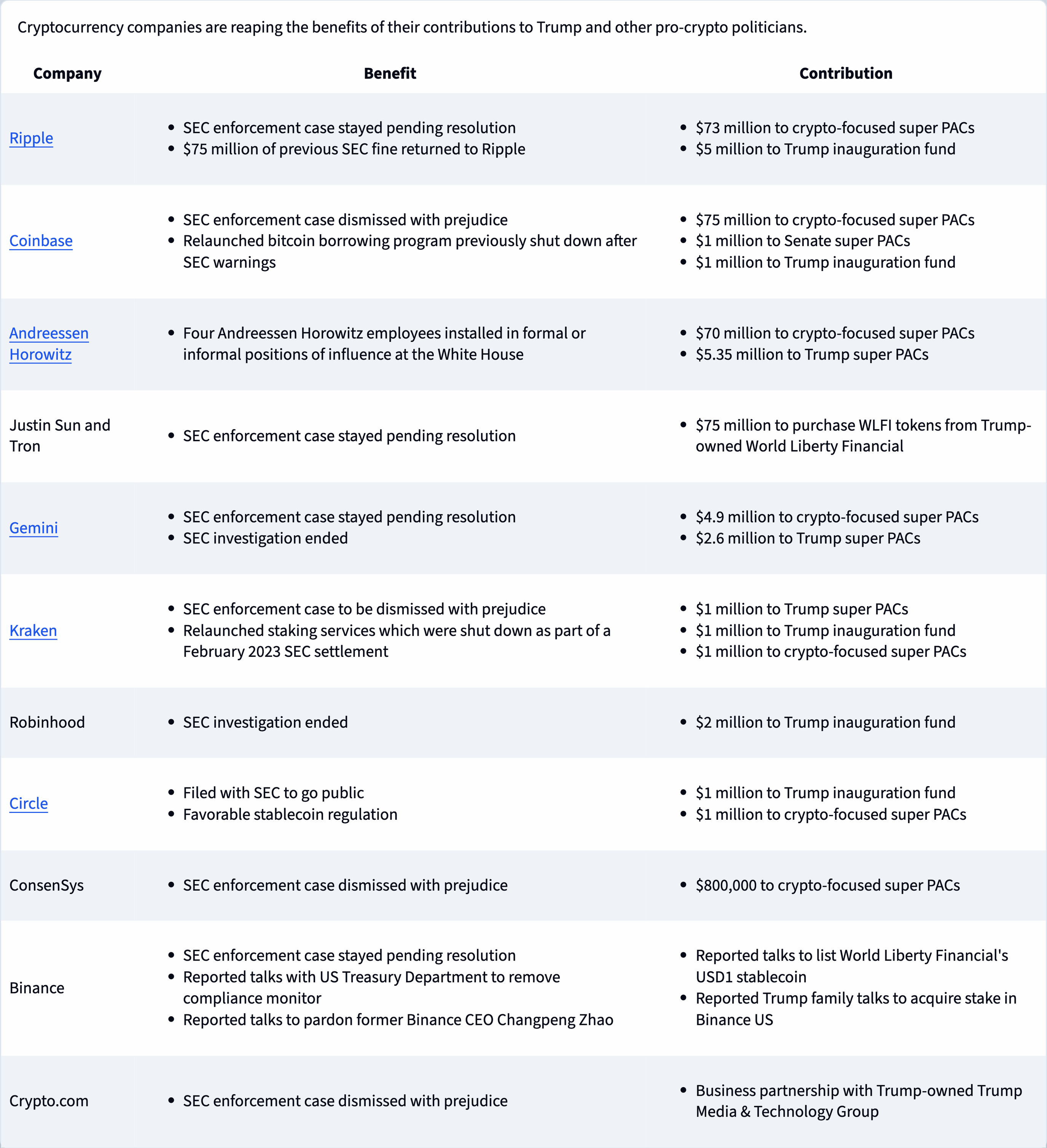

Trump receives 75% of protocol revenues and owns a 60% stake in the World Liberty Financial crypto business. This has already netted him almost a $400 million claim on token sale revenue, even though no platform has been launched yet.

The project has already faced accusations of insider trading, and is reportedly in talks to work with Binance as Binance is simultaneously petitioning the US Treasury department to remove the compliance monitor as a result of the company’s criminal conviction.

![Allegations of insider trading and quid pro quo deals [I76] have plagued the project, particularly amid reports of unusual token swaps with other cryptocurrency companies. For example, a World Liberty deal to acquire around $2 million of a Movement Labs token coincided with rumors of Movement’s talks with Elon Musk’s Department of Government Efficiency about integrating blockchain technology into government operations. (Both World Liberty and Movement Labs denied these allegations.)4 But an April 8 memo from Deputy Attorney General Todd Blanche, citing Trump’s executive order on crypto, dismantled the Department of Justice’s cryptocurrency investigations team and directed the Market Integrity and Major Frauds Unit to “cease cryptocurrency enforcement”. This may well have eliminated any remaining chance of a federal investigation into allegations of malfeasance in a business venture controlled by the president and his family [I81].

As for the stablecoin, the timing is significant: World Liberty Financial announced plans to issue USD1 on March 25, and just ten days later the Securities and Exchange Commission published a statement declaring that "covered" stablecoins fall outside its authority, and that companies issuing stablecoins need not register.5 Meanwhile, a Trump-aligned Congress is working to pass new, friendly stablecoin legislation [I79] with substantial direction from the cryptocurrency industry, which spent over $130 million installing crypto-friendly legislators](https://media.hachyderm.io/media_attachments/files/114/355/777/214/775/738/original/f150e82be4123c6c.png)

![When Trump was inaugurated, he dropped the pretense and took majority control of the company with a 60% stake.2

The project hasn’t launched a trading platform, but the Trumps have discussed a decentralized finance platform for crypto financial services with promises of “democratiz[ing] finance”.2 Recently, World Liberty announced its own stablecoin, USD1 (despite Trump’s past warnings about similar cryptocurrencies, which he described as currencies that “would give a federal government — our federal government — absolute control over your money” [I80]).

And not having any actual platform to speak of has of course not limited World Liberty Financial from raking in money — it raised $550 million in its initial $WLFI token sale, putting Trump’s 75% cut at almost $400 million. $75 million came from Justin Sun, a crypto entrepreneur with a shady past [I71] who, as a foreign national, couldn’t contribute to Trump’s campaign. He was, at the time, facing a lawsuit from the Securities and Exchange Commission alleging fraud. Recent reporting also suggests he was under investigation by the Justice Department, at least as of late 2024.3 With his investment, he earned an advisory position with World Liberty Financial, and shortly after Trump was inaugurated, the SEC case against him and his company was stayed pending potential resolution [I78].](https://media.hachyderm.io/media_attachments/files/114/355/776/194/394/953/original/a5316277f0f31770.png)

Content Warning

![Truth Social and Truth.Fi

Trump Media & Technology Group, behind Trump’s Truth Social platform, is also newly exploring the cryptocurrency world. Trump owns about 53% of the shares, estimated to be worth around $2 billion, in the publicly traded company, which recently submitted filings to allow the trust holding his shares (controlled by Donald Trump Jr.) to sell them [I81].

In January, the company announced it would enter the fintech space with a brand called Truth.Fi, focusing on “America First investment vehicles”.6 On March 24, TMTG announced a partnership with Singapore-based crypto exchange Crypto.com — a company under SEC investigation, that had in August 2024 received a Wells notice informing them of an impending enforcement action [I68]. On March 27, only three days after the partnership announcement, Crypto.com revealed that the SEC had dropped its investigation [I81].

Simultaneously with its announcement about entering fintech, TMTG announced it would allocate up to $250 million of its cash reserves into investment vehicles including bitcoin and other cryptocurrencies.7 By investing in crypto, the company (and thus Trump) stands to profit from Trump’s own actions to pump crypto prices, including announcing a bitcoin strategic reserve to “elevate this critical industry”, and exploring avenues to use government money to buy bitcoin [I80].](https://media.hachyderm.io/media_attachments/files/114/355/780/088/847/446/original/f71ed3f480e2c50d.png)