Adding to pre-existing market jitters, the crypto world has just experienced a new record-shattering hack of the cryptocurrency exchange Bybit. Bybit is less known in the United States, as it is not permitted to serve US customers, which is probably why this hack has not earned the media attention of some of the other major industry disasters. However, Bybit is the second-largest exchange globally, ahead of Coinbase and behind Binance. On February 21, attackers stole more than 400,000 ETH (priced at around $1.5 billiona) from one of the company’s so-called “cold wallets”. Cold wallets are crypto wallets that are not routinely connected to the internet, making them less vulnerable to thefts. As a result, crypto exchanges often store substantial quantities of assets in cold wallets, transferring smaller amounts as needed to online “hot wallets” to satisfy withdrawals and purchases. However, any time these transfers happen, there’s some degree of vulnerability, and that’s what North Korea’s state-sponsored Lazarus cybercriminals were able to exploit.7 They were able to manipulate the Safe Wallet multisignature system used by Bybit to authorize transfers from the cold wallet to the company’s hot wallet, and when the Bybit employees signed off on what they thought was a routine transfer, the wallet was drained. Bybit and Safe are now pointing fingers at one another, with Bybit claiming that Safe’s infrastructure was compromised, allowing an attacker to manipulate the transaction s

![Truth Social and Truth.Fi

Trump Media & Technology Group, behind Trump’s Truth Social platform, is also newly exploring the cryptocurrency world. Trump owns about 53% of the shares, estimated to be worth around $2 billion, in the publicly traded company, which recently submitted filings to allow the trust holding his shares (controlled by Donald Trump Jr.) to sell them [I81].

In January, the company announced it would enter the fintech space with a brand called Truth.Fi, focusing on “America First investment vehicles”.6 On March 24, TMTG announced a partnership with Singapore-based crypto exchange Crypto.com — a company under SEC investigation, that had in August 2024 received a Wells notice informing them of an impending enforcement action [I68]. On March 27, only three days after the partnership announcement, Crypto.com revealed that the SEC had dropped its investigation [I81].

Simultaneously with its announcement about entering fintech, TMTG announced it would allocate up to $250 million of its cash reserves into investment vehicles including bitcoin and other cryptocurrencies.7 By investing in crypto, the company (and thus Trump) stands to profit from Trump’s own actions to pump crypto prices, including announcing a bitcoin strategic reserve to “elevate this critical industry”, and exploring avenues to use government money to buy bitcoin [I80].](https://media.hachyderm.io/media_attachments/files/114/355/780/088/847/446/original/f71ed3f480e2c50d.png)

![Allegations of insider trading and quid pro quo deals [I76] have plagued the project, particularly amid reports of unusual token swaps with other cryptocurrency companies. For example, a World Liberty deal to acquire around $2 million of a Movement Labs token coincided with rumors of Movement’s talks with Elon Musk’s Department of Government Efficiency about integrating blockchain technology into government operations. (Both World Liberty and Movement Labs denied these allegations.)4 But an April 8 memo from Deputy Attorney General Todd Blanche, citing Trump’s executive order on crypto, dismantled the Department of Justice’s cryptocurrency investigations team and directed the Market Integrity and Major Frauds Unit to “cease cryptocurrency enforcement”. This may well have eliminated any remaining chance of a federal investigation into allegations of malfeasance in a business venture controlled by the president and his family [I81].

As for the stablecoin, the timing is significant: World Liberty Financial announced plans to issue USD1 on March 25, and just ten days later the Securities and Exchange Commission published a statement declaring that "covered" stablecoins fall outside its authority, and that companies issuing stablecoins need not register.5 Meanwhile, a Trump-aligned Congress is working to pass new, friendly stablecoin legislation [I79] with substantial direction from the cryptocurrency industry, which spent over $130 million installing crypto-friendly legislators](https://media.hachyderm.io/media_attachments/files/114/355/777/214/775/738/original/f150e82be4123c6c.png)

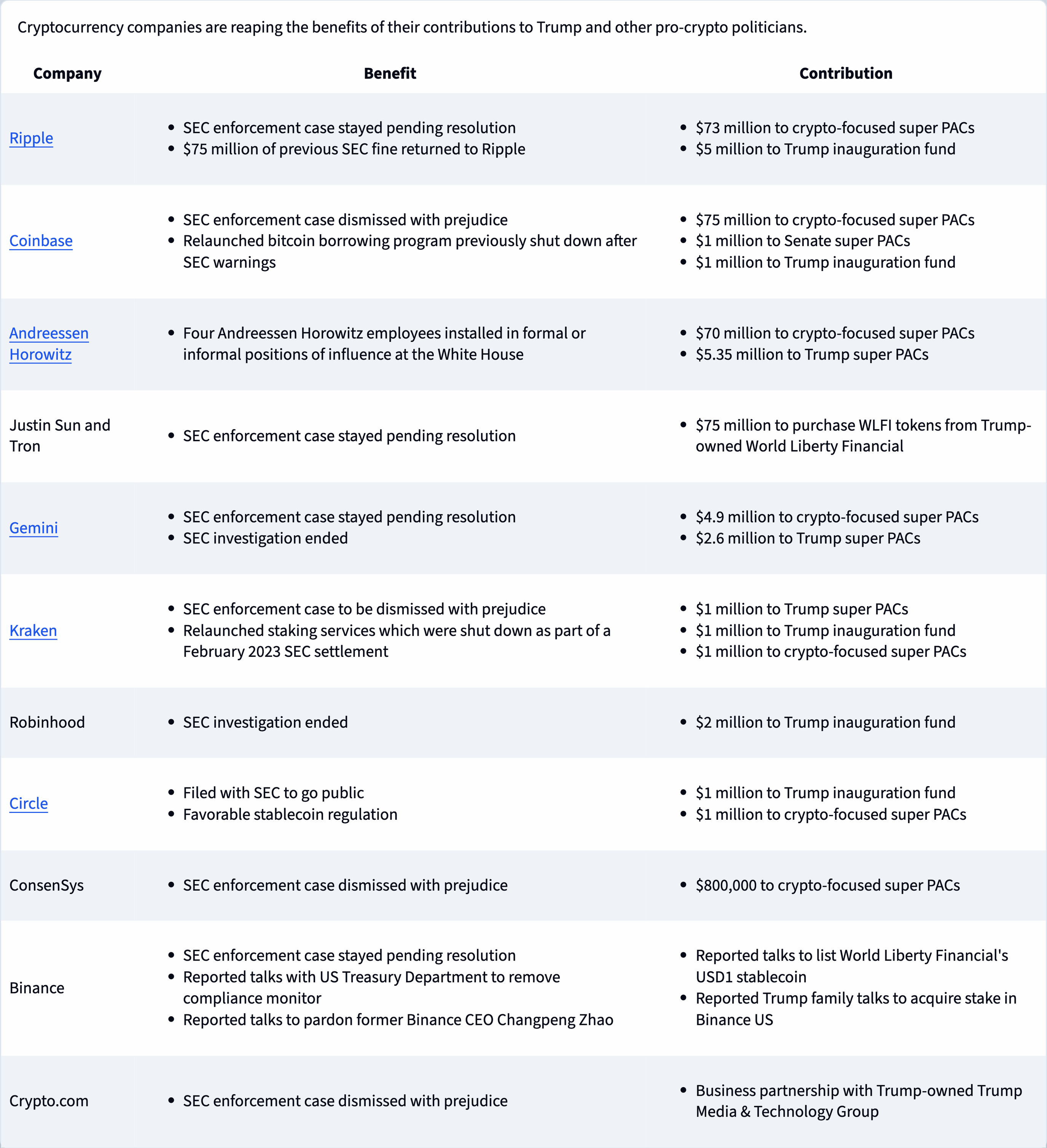

![When Trump was inaugurated, he dropped the pretense and took majority control of the company with a 60% stake.2

The project hasn’t launched a trading platform, but the Trumps have discussed a decentralized finance platform for crypto financial services with promises of “democratiz[ing] finance”.2 Recently, World Liberty announced its own stablecoin, USD1 (despite Trump’s past warnings about similar cryptocurrencies, which he described as currencies that “would give a federal government — our federal government — absolute control over your money” [I80]).

And not having any actual platform to speak of has of course not limited World Liberty Financial from raking in money — it raised $550 million in its initial $WLFI token sale, putting Trump’s 75% cut at almost $400 million. $75 million came from Justin Sun, a crypto entrepreneur with a shady past [I71] who, as a foreign national, couldn’t contribute to Trump’s campaign. He was, at the time, facing a lawsuit from the Securities and Exchange Commission alleging fraud. Recent reporting also suggests he was under investigation by the Justice Department, at least as of late 2024.3 With his investment, he earned an advisory position with World Liberty Financial, and shortly after Trump was inaugurated, the SEC case against him and his company was stayed pending potential resolution [I78].](https://media.hachyderm.io/media_attachments/files/114/355/776/194/394/953/original/a5316277f0f31770.png)

![Although he’s currently in prison, Sam Bankman-Fried has managed to resurface. Not long after rumors emerged that his parents were investigating the possibility of securing a pardon for their son [I76], Bankman-Fried gave a jailhouse interview to the New York Sun. Bankman-Fried, a Biden megadonor who was second only to George Soros in political contributions to the Democratic party in 2021–22, now claims he too is a victim of the Biden-led “prosecutorial abuse” and “politicization of the DOJ” that Trump has alleged for years. Why would they target him? Because, he says, they learned he was “giving to” and “working with” Republicans and conservatives more than was previously known.34 In the interview, he also gave an approving nod to Elon Musk’s “chainsaw” approach to government cuts — something he would extrapolate upon in a 10-tweet long thread posted a few days later, where he apparently felt the need to make his return to Twitter in order to give his thought leader-style take on widespread firings of federal employees.35c The sudden about-face is a rather transparent and groveling attempt to suck up to Trump, but it’s not terribly surprising that Bankman-Fried’s once claimed strongly held moral beliefs have wilted in the face of the possibility of 25 long years in prison.](https://media.hachyderm.io/media_attachments/files/114/095/874/964/705/867/original/afbc9d355624ea14.png)

![The revolving door has spit out former Representative and longtime crypto industry ally Patrick McHenry (R-NC) into roles at not one but three industry players. He will be joining Andreessen Horowitz as a senior adviser, where he will “help innovators navigate the policy landscape”, touting his time in Congress “remov[ing] bureaucratic barriers for American entrepreneurs”. He wrote that “It’s time to level the playing field and ensure that Little Tech—the next generation of builders—gets a fair shot.”36 (“Little Tech” in this case apparently meaning the largest venture capital firm in the world, which is so very small that it was able to blow $83 million on political contributions to ensure that no fewer than four of its employees were placed in major White House roles, including as the likely upcoming head of the crypto industry’s chosen regulator, the CFTC). Any mention of everyday American and the fairness of their shots was conspicuously absent in McHenry’s statements.](https://media.hachyderm.io/media_attachments/files/114/095/878/019/312/901/original/133508b1aecff088.png)

![Besides the mention of specific crypto assets, Trump’s post doesn’t actually appear to announce anything new, and instead reiterates that his “Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve” [I75]. (I will note that the actual wording of the EO was more guarded, directing the working group not to “move forward on” a strategic reserve, but rather to “evaluate the potential creation and maintenance of a national digital asset stockpile”.) Nonetheless, crypto prices rallied a bit, with bitcoin returning to around $93,000. This was still somewhat of a subdued recovery, only juicing bitcoin back to around its February 25 price, leaving me wondering how many promises Trump has left in the tank to keep bitcoin prices pumped up as they are now. Without the actual government infusion of cash into bitcoin markets via this “strategic reserve” gambit — something that may yet be a ways off, could take various forms, and could fail to materialize entirely — words alone seem to be running out.](https://media.hachyderm.io/media_attachments/files/114/095/860/122/436/849/original/182e80f0ad58497d.png)

![Bybit CEO Ben Zhou was quick to try to reassure customers that “Bybit is Solvent even if this hack loss is not recovered, all of clients assets are 1 to 1 backed, we can cover the loss.”14 Many customers weren’t satisfied with his promises,b and they withdrew a combined more than $5.5 billion from the exchange after the theft was announced. Bybit was able to satisfy the withdrawals, and has since said they “closed the gap” in ETH supplies to back client assets through a combination of OTC purchases and loans from exchanges and crypto VCs.15

The lack of skepticism around Bybit’s solvency is a little odd to me. For one, it’s clear that the assets were not 1:1 backed at the time of Zhou’s tweet, given that 400,000 ETH had just been stolen. Bybit later issued a press release boasting that they were “Fully Backed Within 72 hours”, acknowledging themselves that customer balances weren’t fully backed for those three days.16 Furthermore, much of the “gap” has been papered over with loans rather than the firm’s own assets. As we saw with Genesis’s $1.1 billion “loan” to try to cover losses in 2022 [I74], a company’s ability to secure a loan to cover a hole does not magically make that hole disappear. While Bybit’s proof-of-reserves demonstrates that the company now holds a sufficient quantity of ETH to back customer balances, these reports do not evaluate Bybit’s ability to repay the loans or provide any information about the terms of those loans.](https://media.hachyderm.io/media_attachments/files/114/095/866/078/820/582/original/2aa297d48770d044.png)

![The Lazarus group is an extremely sophisticated cybercrime group that has been responsible for many of the chart-topping attacks in the crypto world, including the previously recordbreaking thefts of $625 million from the Axie Infinity game in March 2022 [W3IGG], and the the $300 million and $235 million hacks of the exchanges DMM [W3IGG] and WazirX [W3IGG] in May and July 2024. Their expertise means that they know how best to launder the stolen funds without causing serious impacts to the ETH price or risking the funds being frozen by exchanges and other centralized entities, and they have successfully laundered more than half of the stolen assets thus far by swapping it across various chains and into different crypto assets.9 While a substantial $43 million in stolen assets was frozen and recovered by the mETH Protocol, as was around $181,000 in Tether, that amounts to less than 3% of the total.10

To put this theft in perspective, the $1.5 billion stolen from Bybit alone surpasses the North Korean cyberattackers’ entire 2024 profits from crypto heists: around $1.34 billion from across 47 separate attacks throughout 2024. It’s more than double what they stole the year prior.11 According to the United Nations and the US government, these thefts have been a substantial source of funding for the country’s nuclear and ballistic missile programs.1213](https://media.hachyderm.io/media_attachments/files/114/095/863/859/512/065/original/6fab75329549d6cb.png)

![SEC

Trump’s nominee for SEC Chair, Paul Atkins [I71], has not even been confirmed yet, but that hasn’t stopped the agency from barreling ahead with the new administration’s promises to the industry that all their problems would go away.

Most notably, the SEC case against Coinbase was dismissed with prejudice, meaning the SEC cannot refile the case in the future. CEO Brian Armstrong was explicit with his thanks when announcing the dismissal on Twitter: “I have to give credit here to the Trump administration, for winning the election”. He insisted that he believed “we would have won this case in the courts either way”, but noted that Trump’s election “certainly helped accelerate the process”.23 Coinbase has spent $75 million on contributions to crypto-focused super PACs, some apparently in violation of federal election law, and contributed $1 million to Trump’s inauguration fund.

A case against Justin Sun and his Tron project, opened in March 2023 and alleging fraudulent market manipulation “through extensive wash trading”, “orchestrating a scheme to pay celebrities to tout TRX and BTT without disclosing their compensation”, and unregistered securities offerings, has been stayed as parties “consider a potential resolution”.24 As a foreign national, Sun is not permitted to make contributions to American political candidates or committees. However, he has spent $75 million purchasing World Liberty Financial’s WLFI tokens, and Trump personally gets a 75% cut of that project’s re](https://media.hachyderm.io/media_attachments/files/114/095/867/956/631/439/original/75856fc38c137b55.png)